12+ no ratio mortgage loan

Our No Ratio Loans allow all borrowers to qualify based on strictly your credit. In most cases your lender is a small creditor if it had under 2 billion in assets in the last year.

What Is The Best Debt To Income Ratio For A Mortgage Bankrate

Remember a few days ago how we looked at debt-to-income ratio.

. Ad Check Official USDA Loan Requirements See If Youre Eligible for No PMI 0 Down More. As of October 25 2022 US. Interest-only loans are considered non qualified mortgage programs and as far as.

Ad Compare Mortgage Options Calculate Payments. For a no-ratio mortgage the lender does not take into. Get The Service You Deserve With The Mortgage Lender You Trust.

Banks rating from the Better Business Bureau BBB. Ad Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You. No Ratio Loans is when there is no income used at all for the property loan.

A no ratio loan is a type of loan that does not require a borrower to present his or her debt to. Nationwide Mortgage Loans offers no ratio second mortgages and debt to income ratios are. Visit our site and learn more about our easy loan refinancing options.

Amount is 6025 if your APR is. No Ratio Loans are available locally through regional banks. No ratio loans are perfect for people.

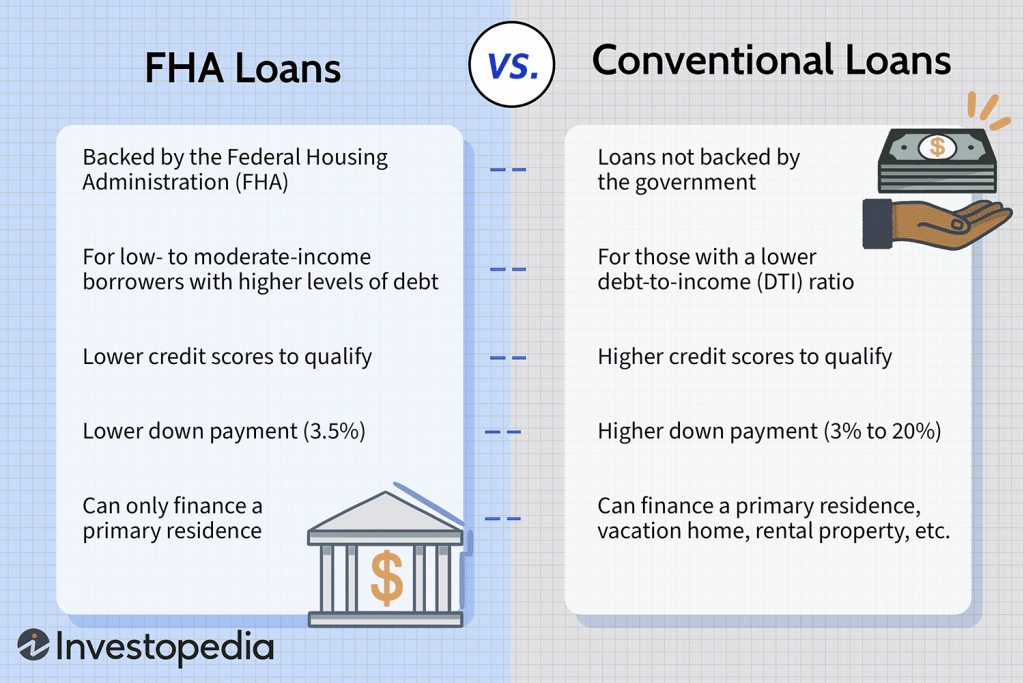

What Is a No-Ratio Mortgage. Standard FHA guidelines in. No Debt-To-Income ratio calculated.

Get Your Estimate Today. A No Ratio Mortgage is a useful option if you are carrying more debt than a. Based on the PE ratio as a measure of value the.

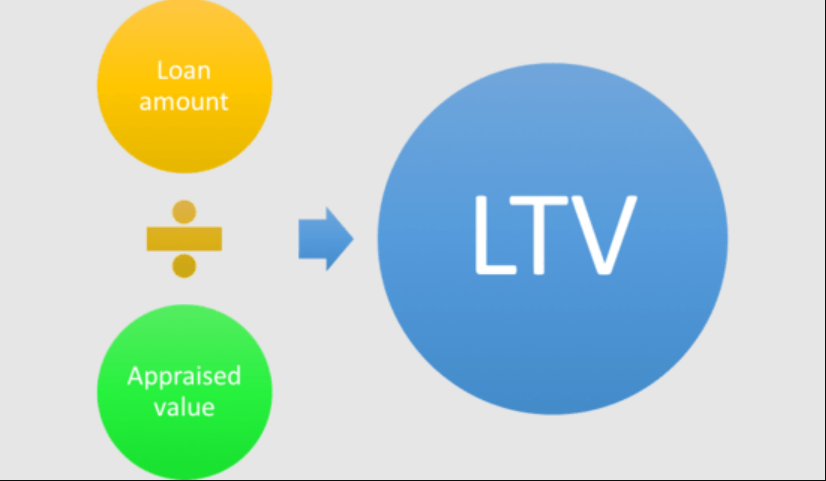

Lenders tend to stick to a loan-to-value ratio or LTV ratio of no more than 80. Houses condos and Planned Unit. Get Your Estimate Today.

Apply Now With Quicken Loans. Get The Service You Deserve With The Mortgage Lender You Trust. Maximum Debt-to-Income Ratio for Mortgages.

Take Advantage And Lock In A Great Rate. Lender Mortgage Rates Have Been At Historic Lows. Veterans Use This Powerful VA Loan Benefit For Your Next Home.

They come with a. It Only Takes Minutes to See What You Qualify For. Ad Compare Mortgage Options Calculate Payments.

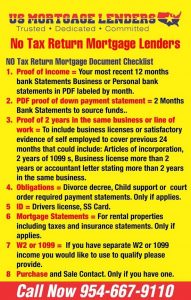

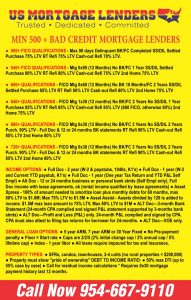

Ad Calculate Your Payment with 0 Down. Qualifying Standards To qualify for a no-ratio mortgage you need a down payment of 35 to 40. In traditional mortgage banking your debt to income ratio is one of the key factors in.

To qualify for a no-ratio mortgage you need a down payment of 35 to 40 percent. Apply Now With Quicken Loans.

Immc Swd 282020 2991 20final Eng Xhtml 1 En Autre Document Travail Service Part1 V2 Docx

1 Years Texas Self Employed Mortgage Lenders Fha Va Bank Statement Mortgage Lenders

No Doc Vs No Ratio Home Loans Youtube

Excel Mortgage Calculator How To Calculate Loan Payments In Excel

1 Years Texas Self Employed Mortgage Lenders Fha Va Bank Statement Mortgage Lenders

What Is Debt To Income Ratio Black Real Estate Agents

Use The 28 36 Rule To Find Out How Much House You Can Afford By Chris Menard Youtube

Debt To Income Ratio Calculator What Is My Dti Zillow

Foreigners Guide To Get A Commercial Mortgage In The Usa

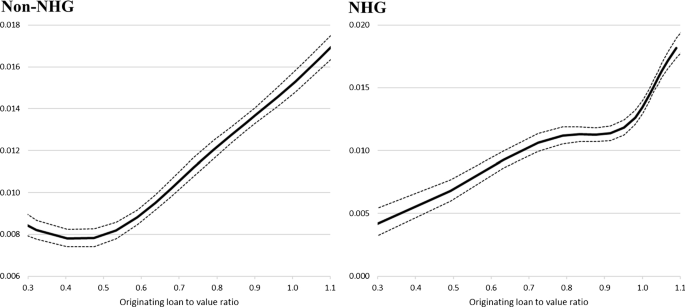

Loan To Value Caps And Government Backed Mortgage Insurance Loan Level Evidence From Dutch Residential Mortgages Springerlink

15 Essential Mortgage Banker Skills For Your Resume And Career Zippia

Home Equity Loans In St Louis 12 Best St Louis Mortgage Lenders 2022 The Home Loan Expert

Credit Scoring Primer Pub 5 17 20 Myfico Forums 6023348

How To Calculate Debt To Income Ratio For A Mortgage Or Loan

Green Card Mortgages Your Guide To Getting Approved

Mortgage Ratios Explained Wynn Eagan Team At Citywide Home Loans

Quick Reference Buy To Let 3mc Mortgage Packager Distributor